Looking to rent a property in Lafayette? I know the process might seem overwhelming at first. There are listings to search, applications to complete, and terms to decipher. Maybe you’ve wondered, “What’s the real cost? What paperwork do I need? Am I missing any vital steps?” I’ve been there, and I understand how important it is to move in feeling secure and informed.

In this guide, I’ll walk you through the Lafayette rental process step by step, offering clear explanations and practical advice to help you make confident choices. Whether you’re new to renting or experienced but need a local refresher, I’m here to help you find your way, minimize stress, and set yourself up for rental success.

Key Takeaways

- Start your Lafayette rental process early to secure the best options and negotiate favorable terms.

- Prepare a detailed budget that accounts for all rental fees, deposits, and ongoing expenses before applying.

- Have essential documents ready—ID, proof of income, and references—since landlords in Lafayette screen applicants carefully.

- Read every section of your lease agreement, and clarify any unclear Lafayette rental terms before signing.

- Complete a move-in inspection, set up utilities, and get renters insurance to protect your interests from day one.

Understanding the Lafayette Rental Market

Lafayette’s rental market is growing, offering a broad range of properties from downtown apartments to single-family homes in quiet neighborhoods. Prices fluctuate depending on location, size, and included amenities. On average, you’ll find that rentals closer to campus or downtown may cost more due to convenience and demand.

Over the past few years, I’ve watched as demand surges during certain seasons, especially summertime and early fall, when students and professionals relocate. It’s a good idea to start your search early to have more options and better negotiating power. Do you prefer a move-in-ready apartment, or are you open to a house further from the city center that might offer more space for your budget? Understanding your priorities will make your search smoother.

Rental listings typically provide details on monthly rent, deposits, pet fees, and sometimes perks like included utilities or parking. It’s wise to clarify what’s covered in your rent to avoid surprises later. I find that markets like Lafayette require flexibility and a bit of patience, but there are plenty of great options if you know where to look.

Preparing to Rent: Budgeting and Requirements

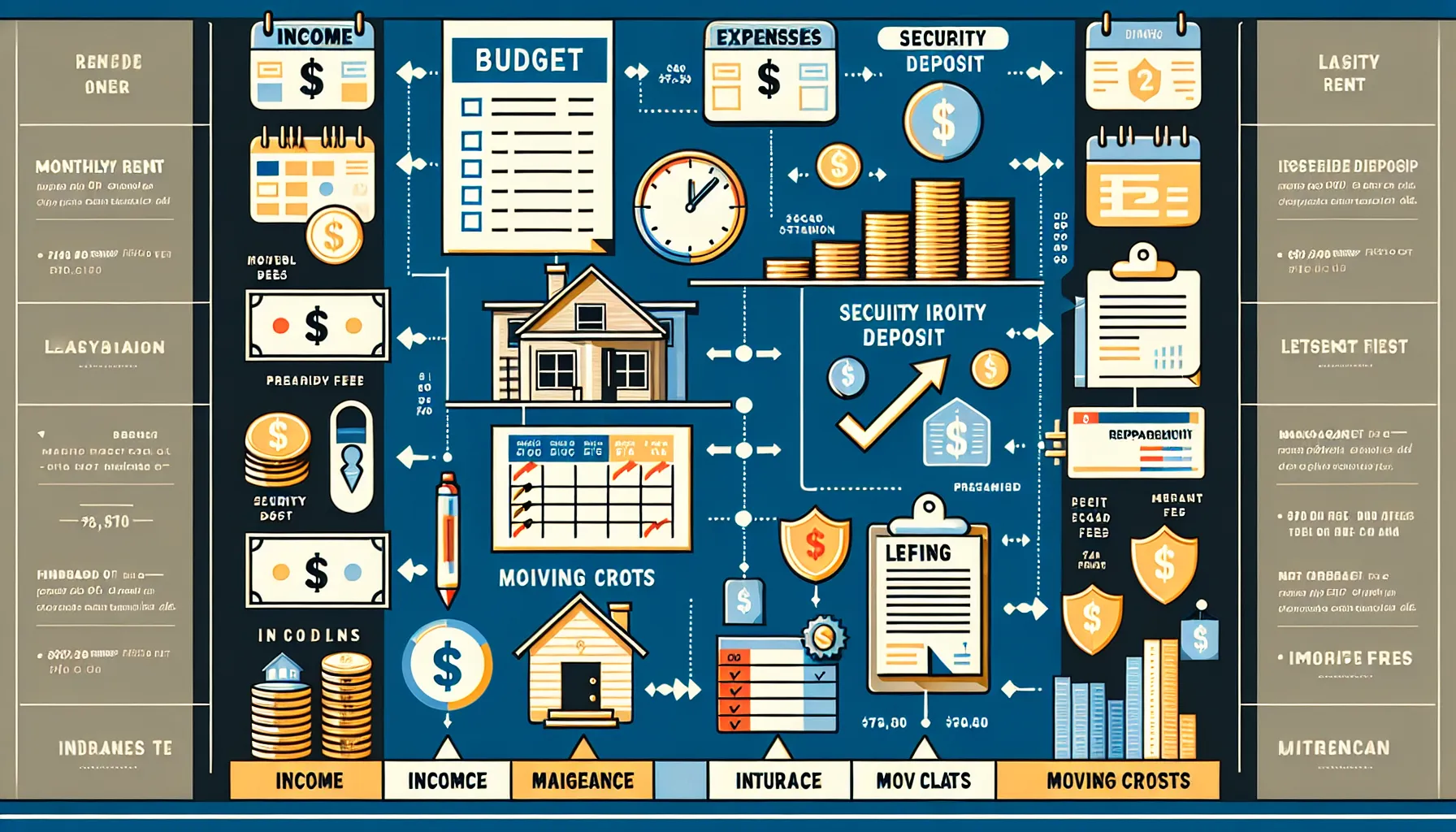

Before you jump into listings, it’s important to have a firm grip on your budget. Most landlords expect your gross monthly income to be at least three times the monthly rent. Take stock of your current income, debts, and essential expenses to figure out how much you can comfortably allocate for housing.

Rental costs go beyond just monthly rent. There are several upfront and recurring fees you should be aware of. For example:

- Leasing fee: $199 (typically a one-time charge)

- Security deposit: Usually equal to one month’s rent, though it can vary

- Monthly management fee: Ranges from 6.5% to 8% of your rent (if you use a management company)

- Set up fee: $100 one-time

- Maintenance and inspections: $75 per visit, semi-annually or annually

- Insurance claims assistance: $100 per claim

- Close-out fee: $100 per property when you move out

Don’t forget about utility deposits, renters insurance, and moving costs. I recommend listing all these expected expenses so you’re not caught off guard. Have you pulled your latest credit report? Landlords will typically want to see a score above 600, steady income, and reliable rental history. If you’re concerned about any of these items, gather reference letters or be prepared to offer a higher deposit.

Searching for Rental Properties in Lafayette

With your budget and criteria set, the real search begins. Online rental platforms remain the go-to resources for most people, these give you access to properties with photos, floor plans, and sometimes even virtual tours. Keep in mind, the Lafayette rental market can move quickly, so it’s important to act fast when you find a place you love.

Offline strategies can be effective, too. Drive through neighborhoods you like and look for yard signs. Sometimes, the best deals come directly from owners who prefer to avoid listing services. Word of mouth is powerful here, let your network know you’re looking. Local property managers, like those who oversee a range of packages in Lafayette, often have access to multiple listings and can match you with something that fits your needs.

When reviewing listings, I focus on the details: Is the property pet-friendly? What’s the parking situation? How quickly are maintenance issues addressed? If it sounds too good to be true, do a bit more digging. If you’re unsure where to start, creating a spreadsheet of properties, fees, contact info, and status helps keep track of your progress and follow-ups.

Application Steps and Screening Process

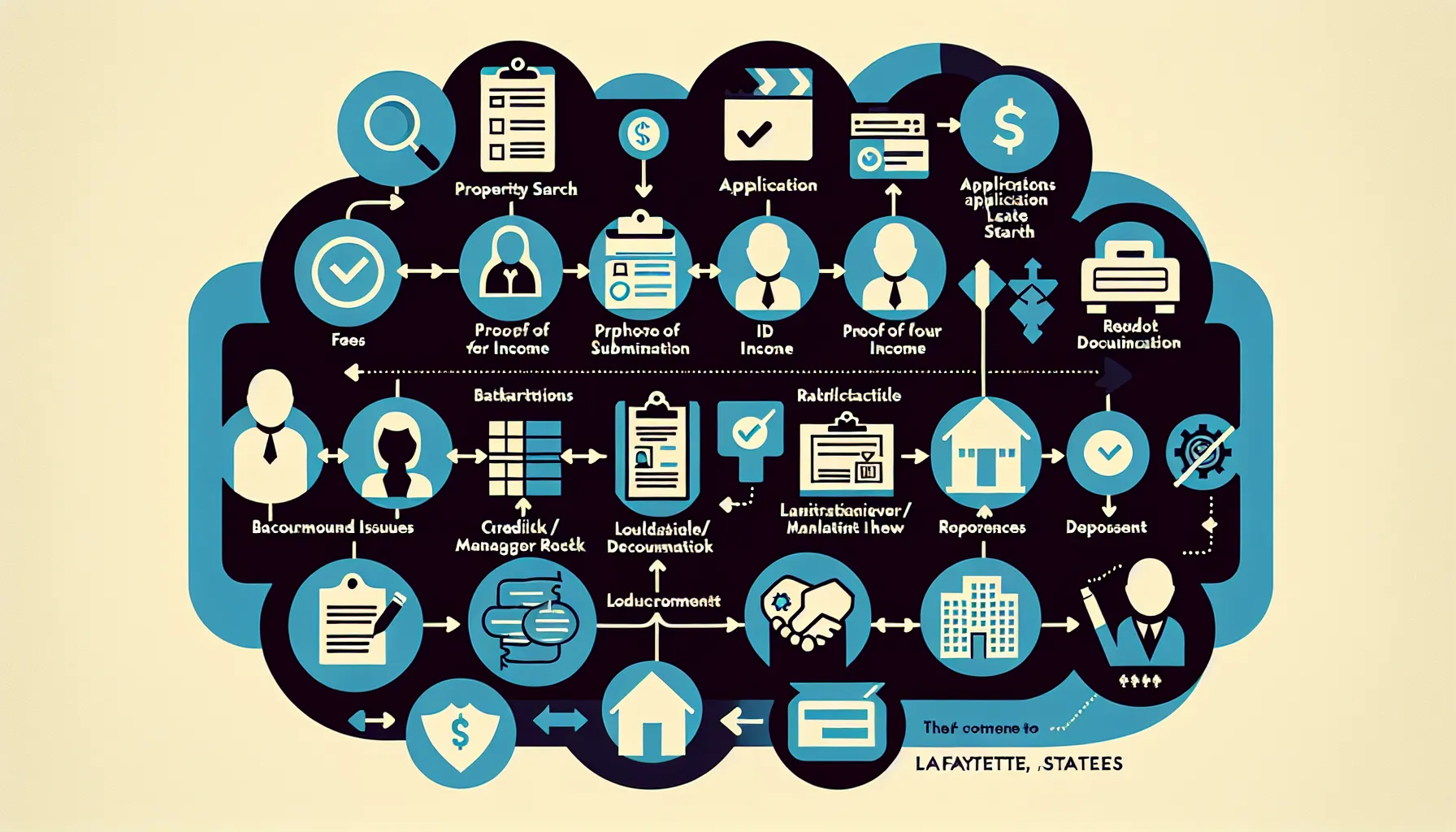

Once you’ve found a property, it’s time to apply. Be ready to act swiftly: Lafayette landlords often require:

- Completed application form

- Government-issued photo ID

- Proof of income (recent pay stubs, bank statements, or employment letters)

- Consent for a credit and background check

- Rental references or employer contact info

An application fee might apply, so ask about costs up front. The property manager or landlord will review your history, credit score, and income to make sure you’re a good fit. Most companies look for on-time payments, stable employment, and positive references. If there’s a hiccup in your background, don’t panic, sometimes honest communication or an extra deposit can help.

Background checks usually cover criminal records and prior evictions. Pet owners may need to provide additional documentation or pay pet deposits. Transparency here goes a long way. Have your paperwork organized, and respond quickly to requests for more information. I find that preparedness can tip the scales in your favor, especially in tight markets.

Lease Agreements and Key Terms to Know

Signing a lease is a major commitment, so I focus on understanding all the terms before making it official. The typical Lafayette lease includes:

- Lease duration: Most are for 12 months, with some flexibility

- Security deposit: Amount and specific conditions for refund

- Rent and fees: Base rent, late payment penalties, parking fees, and any management/maintenance charges

- Maintenance responsibilities: What are you required to handle, and what does the landlord manage?

- Entry policies: Notice required before the landlord or maintenance crew can enter your home

- Early termination and subletting: Rules and potential fees for moving out before your lease is up

I pay close attention to any additional addendums, such as pet policies, smoking rules, or HOA guidelines. If a clause is confusing, ask for clarification, a clear conversation now can prevent misunderstandings later. I also double-check who is responsible for lawn care, pest control, and appliance maintenance, as these vary from lease to lease. Documentation is your best friend, so keep a copy of everything you sign.

Moving In: Inspections and Setting Up Utilities

Before settling in, I schedule a move-in inspection. This is an important step where you walk through with the property manager (or landlord) to document existing issues, like scuffs on the wall or worn flooring. I take photos and jot notes, this small effort helps protect your security deposit when it’s time to move out.

Next, set up utilities in your name. In Lafayette, you’ll usually handle electric, water, gas, and sometimes trash service. Property managers often provide a checklist with contact numbers. If you’re unsure about what you’re responsible for, ask, better early than late. Internet and cable companies may offer bundles, so compare rates for the best fit.

Don’t forget renters insurance. Many landlords require it, and it gives extra peace of mind. On move-in day, I review the property again and keep a copy of my inspection report. That way, everyone is on the same page about the property’s condition from day one.

Conclusion

Finding and securing your Lafayette rental doesn’t have to be stressful. With some upfront planning and an organized approach, I’ve found you can rent with more confidence and less worry. Understand your financial position, keep documents ready, pay attention to terms, and protect your interests through each step.

Have more questions or need guidance as you look for your next place? I encourage you to reach out for clarity on anything rent-related, informed renters are happier renters, after all. With this Lafayette rental process guide at your fingertips, you’re ready to find a great home that meets your needs and keeps you comfortable for the long haul.

Lafayette Rental Process: Frequently Asked Questions

What are the key steps in the Lafayette rental process?

The Lafayette rental process involves preparing your budget, searching and applying for properties, completing background checks, signing a lease agreement, scheduling inspections, and setting up utilities. Staying organized and informed at each stage ensures a smoother rental experience.

What documents are needed to apply for a Lafayette rental property?

Typically, you’ll need a completed application form, photo ID, proof of income, consent for credit and background checks, and rental or employer references. Pet owners may also need to provide additional documents or deposits.

How much does it cost to rent in Lafayette, and what fees should I expect?

Expect to pay monthly rent, a security deposit (usually equal to one month’s rent), application and leasing fees, management fees, setup and close-out fees, and potential maintenance charges. Don’t forget utility deposits, renters insurance, and moving costs.

What should I look for when reviewing Lafayette rental listings?

Check the rent amount, included amenities, lease terms, pet policies, parking, and maintenance response time. Clarify which utilities and services are included to avoid surprises later.

What credit score is needed to rent in Lafayette?

Most Lafayette landlords look for a credit score above 600, along with stable income and a positive rental history. If your score is lower, offering references or a higher deposit may help.

Can I negotiate lease terms with landlords in Lafayette?

Yes, some terms like lease duration, deposit amount, or included amenities can be negotiated, especially if the market is less competitive or you have strong qualifications. Always discuss specific needs before signing the lease.