If you’ve ever wondered whether Pleasant Hill investment property makes sense for your goals, you’re not alone. I often hear from homeowners and investors who are curious about what it really takes to succeed with real estate in this East Bay gem. Maybe you’re holding on to a single rental after relocating, or perhaps your portfolio is growing and you want to take it to the next level. Finding the right approach can feel overwhelming, especially if you want confidence that your investment is in good hands and your returns stay strong.

Let’s explore Pleasant Hill from an investor’s perspective: What shapes the market? What property types offer the best value? And how do you make smart choices that lead to lasting growth? I’ll answer these questions and share practical tips to help you move forward, whether you’re a first-time landlord or a seasoned investor with multiple properties.

Key Takeaways

- Pleasant Hill investment property offers stable occupancy rates and resilient values, making it an attractive choice for investors seeking dependable returns.

- Single-family homes, condos, and multi-family properties each present unique advantages in Pleasant Hill, so align your choice with your investment strategy.

- Careful budgeting for all expenses, understanding rental demand, staying updated on local regulations, and having a clear management plan are essential for success.

- Popular neighborhoods like Downtown Pleasant Hill, Gregory Gardens, and Valley High each offer distinct tenant profiles and growth opportunities.

- Comparing financing options—including conventional loans, portfolio loans, and cash-out refinancing—is critical to maximizing your Pleasant Hill investment property potential.

- Consistent management practices, such as regular rent reviews, responsive maintenance, and effective communication, are key to long-term profitability.

Understanding the Pleasant Hill Real Estate Market

Pleasant Hill sits at a vibrant crossroads in Contra Costa County, drawing families, young professionals, and commuters with its blend of suburban charm and city convenience. As someone who’s worked closely with owners and investors in this area, I can tell you the market has a history of strong tenant demand. Good schools, access to major freeways, and proximity to Walnut Creek and Concord attract residents who want comfort without sacrificing connectivity.

What does this mean if you’re considering Pleasant Hill investment property? For starters, rental homes here generally see high occupancy rates and stable rent prices. Even during broader economic shifts, Pleasant Hill’s real estate has demonstrated resilience. The median home price, while higher than some neighboring cities, is justified by steady appreciation and a tenant pool willing to pay for quality housing and location.

Rental turnover is moderate, translating into lower vacancy costs for owners. I’ve noticed families often sign longer leases, preferring to stay in place for schooling or work. Of course, every investment comes with risks. But if you’re looking for a stable, income-generating asset, Pleasant Hill is well worth your attention.

Types of Investment Properties in Pleasant Hill

Investing in Pleasant Hill gives you several choices when it comes to property type. Each has distinct advantages, so it’s wise to weigh your options:

- Single-family homes: These are consistently popular with families and professionals. They tend to attract stable tenants and offer strong resale value. Many out-of-area homeowners I work with prefer this option because it’s straightforward to manage and attracts high-quality renters.

- Condos and townhouses: If you want lower entry costs or less maintenance, condos can be appealing. They’re especially sought after by singles, retirees, and young couples. Be mindful of HOA fees, which can impact your returns.

- Multi-family properties: Duplexes and small apartment buildings can deliver higher cash flow. With multiple units under one roof, you spread out vacancy risk. Investors with portfolios often gravitate toward these because they scale income efficiently.

Do you know which property type fits your investing style, or are you still evaluating the pros and cons? I’ve helped clients consider purchase price, long-term rental income, and ease of management before deciding. Remember, what works for one investor may not be right for another. I’m always happy to talk through these choices in more detail.

Key Factors to Consider Before Investing

Before diving in, I encourage every new client to take a step back and check off a few key considerations:

- Budget and total costs: It goes beyond the listing price. Think about down payment, closing costs, property taxes, insurance, and ongoing maintenance. I’ve seen too many investors caught off guard by HOA assessments or major repairs, so a line-by-line budget is essential.

- Rental demand: Pleasant Hill’s appeal is strong, but it still pays to analyze vacancy data and comparable rents. A little research goes a long way in projecting cash flow.

- Local regulations: Are you aware of the latest laws affecting landlords? Updates to California rent and eviction rules can impact your strategy, so staying informed is crucial.

- Management plan: Will you handle day-to-day responsibilities yourself, or would partnering with a property manager free up your time? Many clients come to me for a full-service approach, seeking a stress-free, hands-off experience, especially those based out of town.

Making a list and asking yourself these questions can make your investment much smoother. Are there factors you’re still unsure about? Chances are, I’ve helped others with the same concerns.

Neighborhoods and Growth Potential

Pleasant Hill may not be a large city, but it contains a variety of neighborhoods, each with its own character and opportunities for growth.

- Downtown Pleasant Hill: This area is increasingly popular with renters who prioritize walkability, shopping, and entertainment. Properties here typically command higher rents, but entry costs reflect the central location.

- Gregory Gardens: A favorite for families, thanks to established homes, mature trees, and proximity to top schools. Steady appreciation and lower tenant turnover are hallmarks of this pocket, but competition can be fierce.

- Valley High/Norwood Estates: These neighborhoods offer larger lot sizes and quiet streets, drawing long-term tenants who value privacy.

I always suggest that investors spend time walking these areas, checking local amenities, and talking to residents or real estate professionals who know the market inside and out. Growth potential isn’t just about current rents: it’s about understanding which neighborhoods are seeing revitalization, infrastructure upgrades, or demographic shifts that could benefit your bottom line in the coming years.

Have you explored Pleasant Hill’s neighborhoods firsthand? Sometimes that local insight turns a good investment into a standout performer.

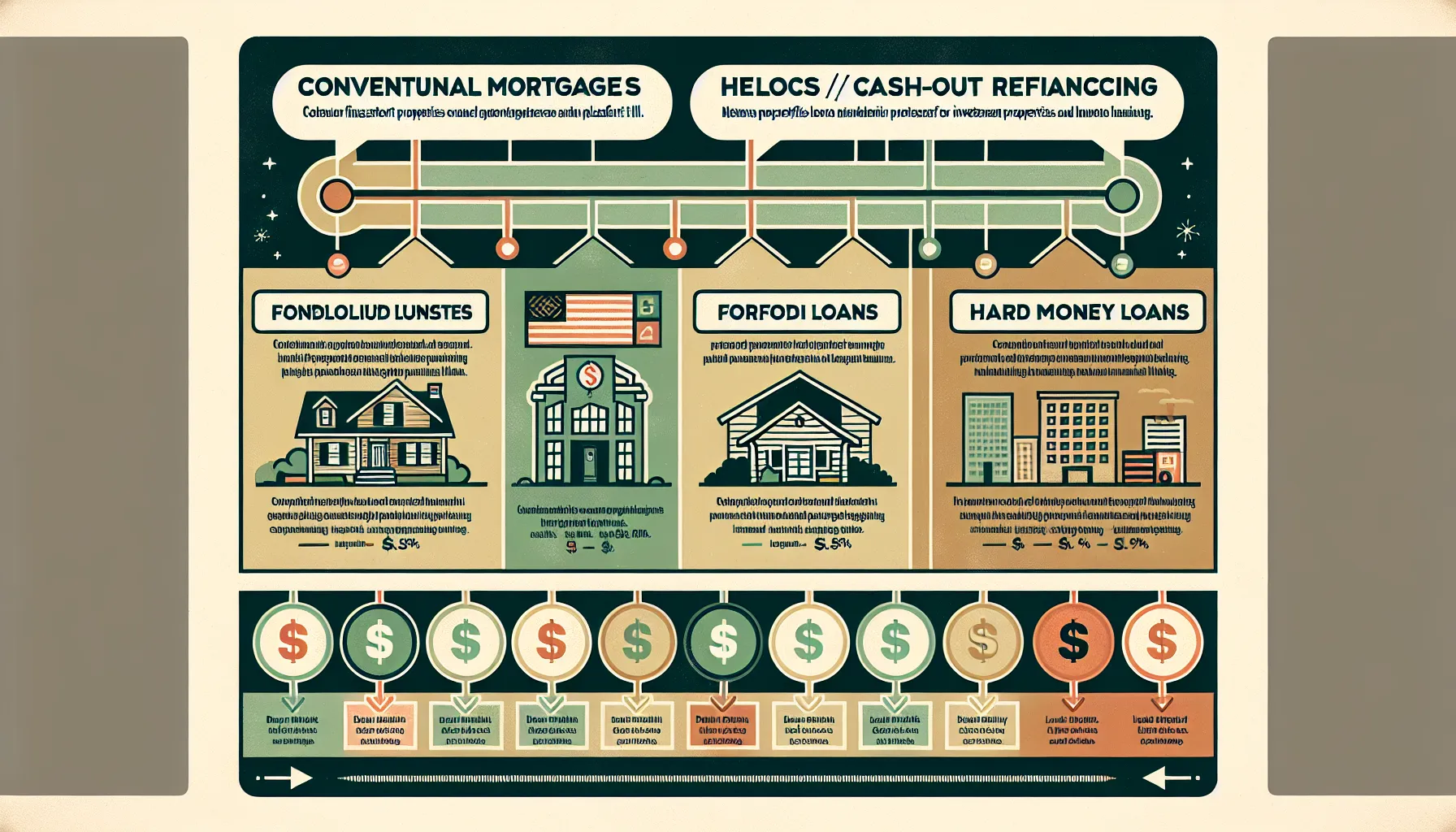

Financing Options for Investment Properties

Securing funding for Pleasant Hill investment property is a critical step, and there are several routes you can take, each with different requirements:

- Conventional mortgages: Most investors start here. These loans typically require a larger down payment (20-25% is common for non-owner-occupied homes) and solid credit scores.

- Portfolio loans: Small banks and credit unions sometimes offer flexible terms for those with multiple properties, making it easier to expand your portfolio.

- HELOCs and cash-out refinancing: If you already have equity in another property, tapping into it can fund your next purchase.

- Hard money loans: Faster approvals and less rigid criteria make these loans a fit for those who want to move quickly, but the interest rates are higher. These work best for fix-and-flip projects or short-term holds.

I often help clients run the numbers based on each option, using real-world rental income scenarios. Comparing monthly mortgage costs, interest rates, and closing fees will clarify which path aligns with your goals. Have you checked with a lender lately to see what’s possible for your specific situation?

Maximizing Returns: Management Strategies and Tips

If you want your Pleasant Hill investment property to deliver steady, long-term returns, the right management approach makes all the difference. Here’s what’s worked best for me and my clients:

- Set appropriate rent: Regularly review comparable listings and adjust rents as the market shifts. Underpricing hurts your returns: overpricing can cause vacancies.

- Routine maintenance: Schedule semi-annual inspections and address repairs promptly. This keeps tenants happy and prevents small issues from becoming expensive headaches.

- Clear lease agreements: A thorough, well-written lease sets expectations and reduces misunderstandings down the road. I always include essential clauses required by California law and review them with tenants before move-in.

- Responsive communication: Tenants appreciate timely responses to requests. I’ve found quick follow-through builds trust and reduces turnover.

- Leverage technology: Online rent payments and maintenance requests streamline processes for everyone. Utilizing these tools keeps both owners and tenants satisfied.

Many of the happiest property owners I’ve worked with are those who put these management tips into practice from day one. Do you feel confident handling these tasks, or would a more hands-off, full-service option better fit your lifestyle? Either approach can work, as long as you have a plan.

Conclusion

Investing in Pleasant Hill property can be rewarding, both financially and personally, if you approach it thoughtfully. By understanding the local market, selecting the right property type, and focusing on smart management, you set yourself up for consistent returns and fewer headaches down the line.

Maybe you’re just beginning your journey or seeking ways to make your existing portfolio work even harder. What next step can help you achieve your investment goals with confidence? I invite you to reflect on what matters most, stability, growth, peace of mind, and reach out if you’d like guidance that comes from hands-on experience in Pleasant Hill and across the East Bay. Your investment deserves care and expertise. Let’s discuss how you can make the most of every opportunity.

Frequently Asked Questions About Pleasant Hill Investment Property

What makes Pleasant Hill an attractive location for investment properties?

Pleasant Hill attracts investors due to strong tenant demand, stable rent prices, and a resilient real estate market. Its proximity to good schools, major freeways, and nearby cities like Walnut Creek and Concord ensures high occupancy rates and steady property appreciation.

Which types of properties are best for investment in Pleasant Hill?

Single-family homes, condos, townhouses, and multi-family properties are all popular investment options in Pleasant Hill. Each type serves different tenant demographics and offers unique advantages, such as stronger resale value or higher cash flow potential from multi-unit properties.

How can I maximize returns on my Pleasant Hill investment property?

Maximizing returns involves setting competitive rents, routine maintenance, using clear lease agreements, and leveraging technology for rent collection. Responsive communication with tenants and considering professional property management can also improve tenant retention and overall profitability.

What are the important factors to assess before buying investment property in Pleasant Hill?

Key factors include your total budget, expected rental demand, local landlord-tenant laws, and your management strategy. Thoroughly assessing costs such as down payments, repairs, HOA fees, and understanding local regulations can help ensure a successful investment.

Are there specific Pleasant Hill neighborhoods that are better for investment properties?

Popular investment neighborhoods in Pleasant Hill include Downtown (high rents, walkability), Gregory Gardens (great for families and low turnover), and Valley High/Norwood Estates (private, larger lots). Each area offers different growth opportunities and tenant profiles.

How do I finance a Pleasant Hill investment property?

You can finance Pleasant Hill investment property through conventional mortgages, portfolio loans, HELOCs or cash-out refinancing, and hard money loans. Each method has distinct requirements and costs, so it’s wise to compare options based on your financial goals.