If you’re searching for a place where your real estate investment can really work for you, Lafayette continues to stand out. Perhaps you’re a homeowner wanting to preserve your California property from afar, or maybe you manage a portfolio and want evidence of impressive results. I understand that you want clarity, and confidence, in your returns, especially with every shift in the market. What drives reliable gains here? How can you make sure your investment continues to prosper? Let me take you through what I’ve learned about Lafayette’s real estate performance, how to make sense of its numbers, and most importantly, how you can make informed decisions for the years ahead.

Key Takeaways

- Lafayette real estate returns are driven by high rental rates, strong appreciation, and reliable occupancy, making it a top choice for investors.

- Maintaining and upgrading properties in Lafayette can significantly boost rental income and long-term value.

- Effective professional management helps maximize returns by ensuring steady cash flow, minimizing vacancies, and reducing costly repairs.

- Lafayette’s real estate market has outperformed many neighboring cities in both home appreciation and rental income stability.

- Investors can enhance Lafayette real estate returns through proactive upkeep, strategic marketing, and careful fee management.

- Planning for market risks, regulations, and unexpected costs is essential for sustaining strong real estate returns in Lafayette.

Understanding Real Estate Returns in Lafayette

When I talk about real estate returns in Lafayette, I’m focusing on two main points: income generated by renting out a property and any appreciation that property gains overtime. It’s easy to get lost in buzzwords, but it boils down to how much money flows into your pocket, through monthly rent and the growth in value of your home.

Rents in Lafayette often command higher rates compared to neighboring areas, thanks to its schools, safety, and community amenities. For property owners who might have moved out of state but decided to hold onto their properties, this translates to steady, reliable monthly income. Investors managing multiple homes here also see measurable results, provided the properties are well-maintained and positioned correctly in the market.

But these returns aren’t automatic: they depend on a mix of smart management and market timing. I’ve found that real estate here offers solid possibilities, but only when paired with ground-level expertise.

Key Factors Influencing Return on Investment

The return you see on a Lafayette property isn’t just a number, it’s shaped by a handful of critical elements:

Location and Neighborhood Desirability

Homes near top-rated schools and walkable downtown areas rent quickly and often appreciate faster. That’s something I always watch closely.

Property Condition and Upgrades

Simple improvements, fresh paint, kitchen updates, or renovated bathrooms, can significantly bump up your rental price. I’ve managed renovations that raised rent by 7–10% without significant downtime.

Local Market Trends

Rental demand ebbs and flows. When more tech workers flock to the Bay Area, rents naturally climb. I keep an eye on job trends and commuter data since they directly impact demand and rent levels.

Professional Management

This is one of the most overlooked variables. Streamlined leasing, attentive tenant vetting, and proactive maintenance preserve cash flow and help sidestep expensive vacancies or repairs. I’ve seen owners try to self-manage, only to face late rent or property wear-and-tear eating into profits.

Costs and Fees

Every management package has different costs, leasing fees, monthly management percentages, marketing boosts, and more. Understanding these is key: the impact on your bottom line can be substantial. For example, for portfolios between $10,000 and $30,000 monthly gross rents, the right management can mean the difference between average and standout returns.

Historical Performance of Lafayette Real Estate

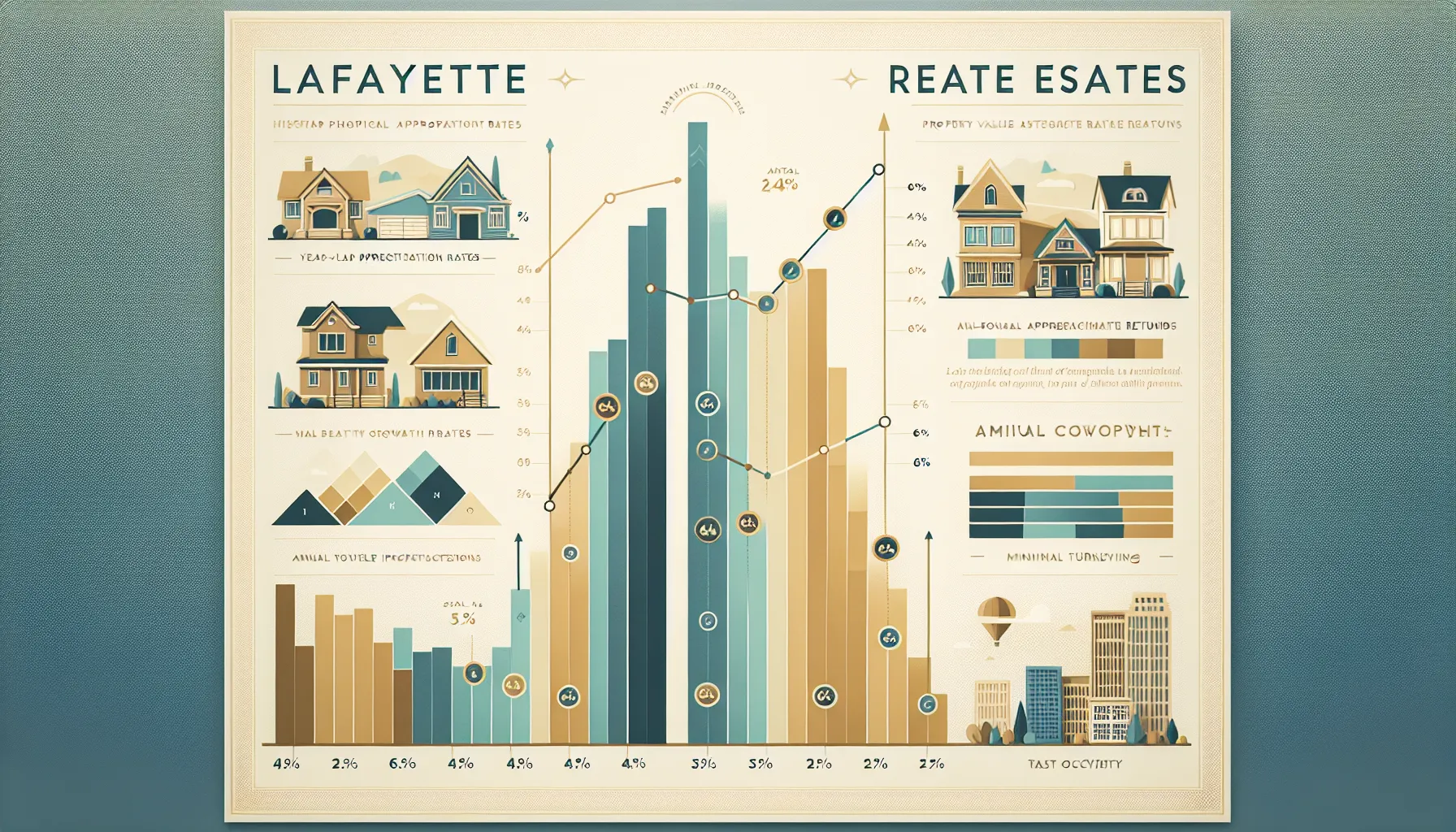

Looking back over the past decade, Lafayette’s real estate market has shown resilience. During periods of regional price declines, Lafayette often recovered quickly or sometimes avoided steep drops altogether. Single-family homes here have appreciated at an average rate above many other East Bay cities. According to market data from recent years, homes in Lafayette have averaged annual appreciation rates of 4–6%.

Rental rates mirror this trend. Landlords regularly report full occupancy and minimal turnover, especially for well-maintained properties. I’ve seen long-term renters happily renew year after year because of the area’s consistent quality of life.

The bottom line? History suggests that Lafayette’s homes hold their value well, and rental income remains stable, even as broader markets fluctuate. But past performance isn’t a promise: it’s a guidepost for where things may be headed.

Comparing Lafayette to Other Regional Markets

Lafayette’s position in the East Bay market makes its returns stand out. While neighboring cities like Concord, Pleasanton, and Antioch offer lower entry prices, the rental yields and appreciation rates in Lafayette are tough to match when you factor in both property demand and long-term growth.

Take Antioch: the up-front investment may be less, but appreciation is often slower, and rents don’t climb as quickly. Pleasanton and Fremont do offer stiff competition, but Lafayette’s strong mix of excellent schools and community character keeps demand high. Even in more affordable spots, properties can sit vacant longer or require more management resources. I’ve worked with clients who diversified into nearby cities, only to find themselves drawn back to Lafayette for the combination of reliability and value growth.

If yield, occupancy, and long-term capital gains all matter to you, Lafayette continues to set a high bar in the region.

Strategies for Maximizing Returns in Lafayette

Through hands-on management, I’ve found several ways investors achieve maximum results with Lafayette properties:

- Invest in Regular Upkeep: Proactive maintenance keeps tenants happy and properties in top shape, reducing costly surprises later.

- Smart Improvements: Renovations with demonstrated ROI, like updating kitchens or adding air conditioning, can push rents higher without long vacancy periods. Overseeing these improvements often yields a strong payback.

- Targeted Marketing: Leveraging digital marketing (like Facebook boosts or Google AdWords) ensures rental listings get seen by the right people. I’ve seen a small investment here translate into quicker leases and better tenants.

- Fee Management: Choosing the best service package for your particular rental income bracket, rather than a generic plan, avoids overpaying and improves net returns. I always encourage property owners to weigh up options, from leasing fees to monthly percentages, before signing on.

- Responsive Communication: Being quick to address both tenant and maintenance issues keeps properties running smoothly and tenants in place.

By combining these strategies, property owners see more reliable income and less stress. It’s about finding the right balance for your situation and acting on it.

Risks and Challenges in the Lafayette Real Estate Market

Even in a strong market like Lafayette, risks remain. Property taxes and insurance premiums can increase without much warning. Legislative changes sometimes shift what you can charge or how quickly you can increase rent.

Market downturns, even if less severe in Lafayette, still affect prices and rental demand. Unexpected vacancies or major repairs might crop up at an inconvenient time. I remind every client: don’t ignore local regulations or assume that Bay Area demand always means a quick lease-up.

The solution? Plan for contingencies. Build reserves for repairs and periods without rent. Stay updated on city ordinances affecting landlords. And above all, don’t treat this as a set-and-forget investment, you have to keep your eye on the local landscape, just as I do.

Conclusion

Investing in Lafayette real estate has consistently delivered compelling returns, whether you manage a single home or an entire portfolio. By understanding the drivers of success here, location, property condition, responsive management, and sound financial planning, you can make the most of what this market has to offer.

Are you ready to rethink your approach or take the next step? Whether you need reliable property oversight from afar or want to grow your income stream, Lafayette stands out. With the right strategies and attention to detail, your investment here can continue to work for you year after year.

Frequently Asked Questions About Lafayette Real Estate Returns

What drives strong real estate returns in Lafayette?

Lafayette real estate returns are typically driven by high rental demand due to excellent schools, community amenities, and a safe environment. Well-maintained properties in desirable locations tend to appreciate faster and generate reliable rental income.

How do Lafayette real estate returns compare to neighboring cities?

Lafayette often outperforms neighboring cities like Concord or Antioch when it comes to long-term appreciation and rent levels. Although entry prices may be higher, the rental yields and property value growth in Lafayette usually make it a more attractive investment.

What strategies can maximize returns on Lafayette real estate?

Investors can maximize Lafayette real estate returns by maintaining properties proactively, making smart upgrades like kitchen remodels, using targeted digital marketing, and selecting the best management service to control costs and attract quality tenants.

What is the average annual appreciation rate in Lafayette?

Over the past decade, Lafayette homes have averaged annual appreciation rates of 4–6%. While past performance isn’t guaranteed for the future, this trend highlights the market’s resilience and growth potential.

How can I mitigate risks in Lafayette real estate investing?

To minimize risks, investors should budget for potential repairs, stay informed about local regulations, and maintain an emergency reserve for vacancies or unexpected expenses. Proactive management and staying updated on market changes are key.

Is Lafayette real estate a good option for out-of-state investors?

Yes, Lafayette real estate offers reliable rental income and property appreciation, making it attractive for out-of-state investors. However, partnering with experienced local property management can be crucial for maintaining high returns and seamless oversight from afar.