Buying property in Lafayette is a significant step, whether you’re searching for that perfect family home or investing for the long term. I know firsthand that property inspections can feel overwhelming, there’s a lot at stake, and you want to protect your investment at every turn. Have you ever wondered what really happens during an inspection, or how to make the most out of your inspection report? I’m here to walk you through each step, using approachable language and real insight, so you can move forward with clarity and confidence. Let’s explore what truly matters about Lafayette property inspections and how to turn this part of the process into your advantage.

Key Takeaways

- A thorough Lafayette property inspection uncovers hidden issues and strengthens your ability to negotiate repairs or price adjustments.

- Hiring a qualified and locally experienced inspector is crucial for accurate assessment of Lafayette’s diverse property types.

- Inspection reports highlight common concerns such as foundation cracks, outdated plumbing, and environmental risks specific to Lafayette’s climate.

- Buyers should use the Lafayette property inspection report both for immediate negotiations and as a valuable maintenance guide after purchase.

- Asking the right questions ensures you select an inspector who communicates clearly and offers narrative, photo-documented reports.

Understanding Property Inspections in Lafayette

Why Property Inspections Are Essential

From my experience, a thorough property inspection does more than just provide peace of mind, it’s your safety net. Issues can hide in the walls, attic, or foundation, escaping even a careful walk-through. By having a professional inspect the home, I know I’m uncovering potential risks before signing final paperwork. These findings not only help me make a smarter investment, but they also put me in a stronger position to negotiate, if anything serious turns up. What would give you the most confidence before committing to a home purchase?

Types of Properties Commonly Inspected

Lafayette features a wide range of properties: charming historic cottages, modern condos, and single-family houses with plenty of character. With such diversity, I always make sure my inspector is familiar with various building ages and construction styles. If you’re buying an older property, for instance, you may encounter outdated systems or materials. If your focus is on newer developments, energy efficiency and code compliance become more important. Every property type comes with its own checklist, and my approach is to prioritize inspection areas based on the property’s age and structure.

What to Expect During a Property Inspection

Inspection Process Overview

On inspection day, I typically meet the inspector at the property, although some folks prefer to join virtually if possible. First, the inspector gives a general explanation of the process and answers any questions I might have. They move systematically from the exterior, checking the roof, siding, and drainage, to the interior, covering everything from attic to basement. Many times, inspectors note both major issues and minor maintenance needs, all in a clear, organized report. Have you ever seen a sample inspection checklist? It’s surprisingly detailed.

Key Areas Inspected

Every good inspection covers the big-ticket items: foundation and structure, roofing, plumbing, electrical systems, heating and cooling, and appliances. I pay close attention to moisture signs, cracks, and anything that seems out of place. In Lafayette, it’s also common to inspect for pests and environmental hazards. Items like window seals, garage door mechanisms, and smoke detectors might seem small but can signal underlying problems if overlooked.

Typical Timeline and Costs

In my experience, a typical inspection takes about 2 to 3 hours, depending on the property’s size and age. You can usually expect to receive the written report within 24 to 48 hours. As for cost, inspections in Lafayette generally range from $350 to $600, though this can vary based on services and square footage. If you add specialized inspections, such as mold, radon, or sewer lines, there may be extra fees, but the insight is usually well worth it.

Common Issues Found in Lafayette Properties

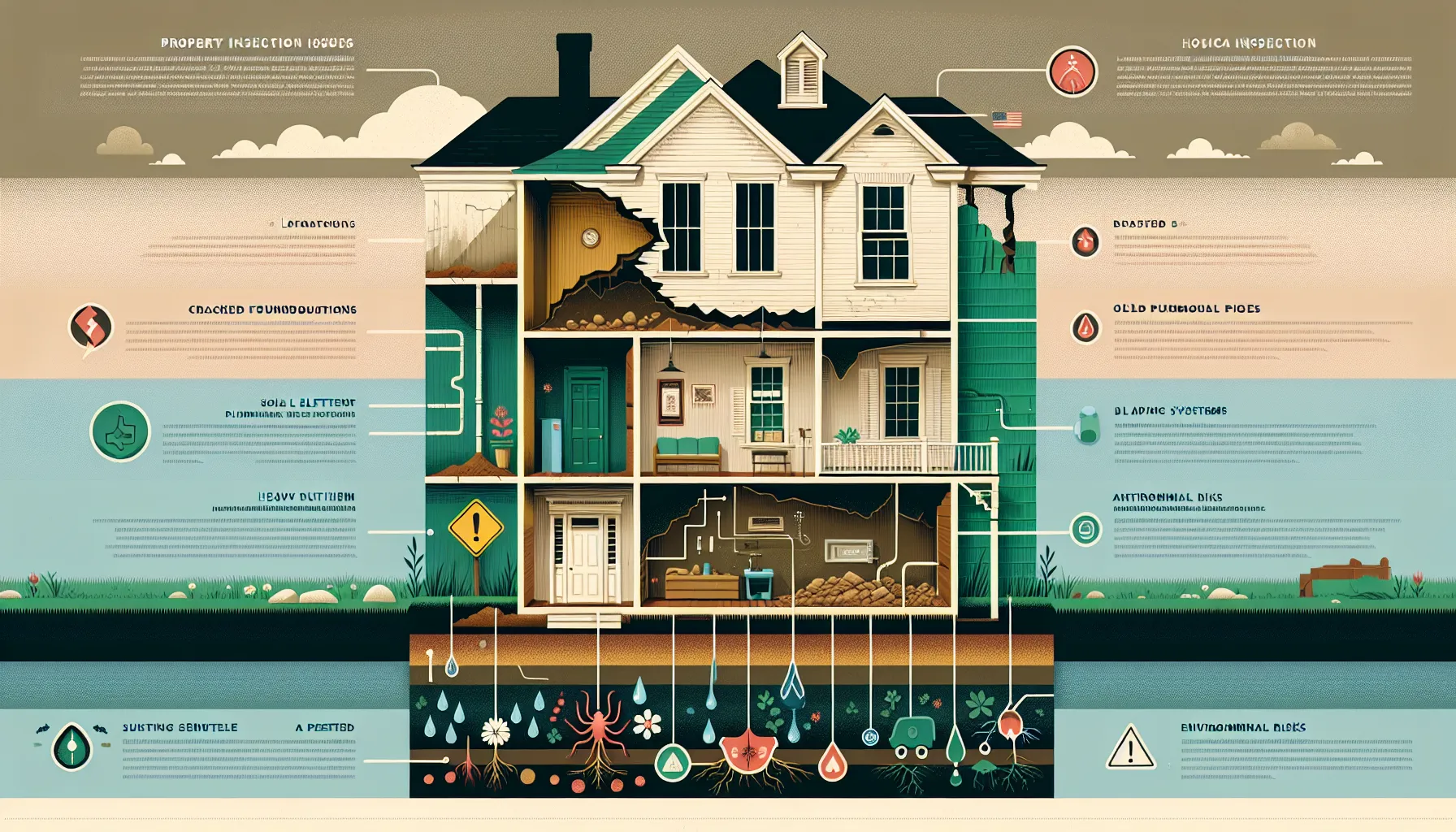

Structural and Foundation Problems

Some of Lafayette’s older homes harbor foundation cracks or settled slabs, mostly due to the region’s shifting soils and occasional heavy rains. I’ve seen reports highlight sloping floors or minor wall separation. While these issues can be alarming, a skilled inspector helps me understand whether they’re costly repairs or just routine maintenance needs. Wouldn’t you want to know about a structural hiccup before making an offer?

Plumbing and Electrical Concerns

Worn-out plumbing is another common find, especially in houses built before the 1980s. Corroded pipes or slow drainage might seem minor but could turn into bigger headaches over time. Outdated electrical panels or exposed wiring are also frequent callouts. These aren’t just about convenience, they’re safety issues that could affect everything from insurance eligibility to long-term comfort.

Environmental and Weather-Related Risks

Because Lafayette can experience both hot summers and plenty of rain, inspectors often identify concerns related to moisture penetration, mold, or even pest intrusion. I always ask about attic insulation and ventilation, since improper airflow can invite issues few buyers anticipate. In some neighborhoods, wildfire regulations or proximity to hillside landscapes add another layer of consideration.

Choosing a Qualified Property Inspector in Lafayette

Licensing and Certification Requirements

When I’m selecting an inspector, I verify their licenses and certifications. In California, inspectors should be familiar with statewide standards, but I prefer someone who’s also active in local or national industry groups, like ASHI or CREIA. I always double-check their insurance coverage too. Why trust this step to chance?

Questions to Ask Potential Inspectors

I’ve found that asking direct questions reveals a lot about an inspector’s experience and approach. For example:

- How many inspections have you completed in Lafayette specifically?

- Will you walk me through major concerns during the inspection?

- Are your inspection reports narrative-based and include photos?

- Can you recommend other specialists if a concern turns up?

The answers help me gauge not just competence, but communication skills, so I feel confident moving forward.

How to Use Your Inspection Report

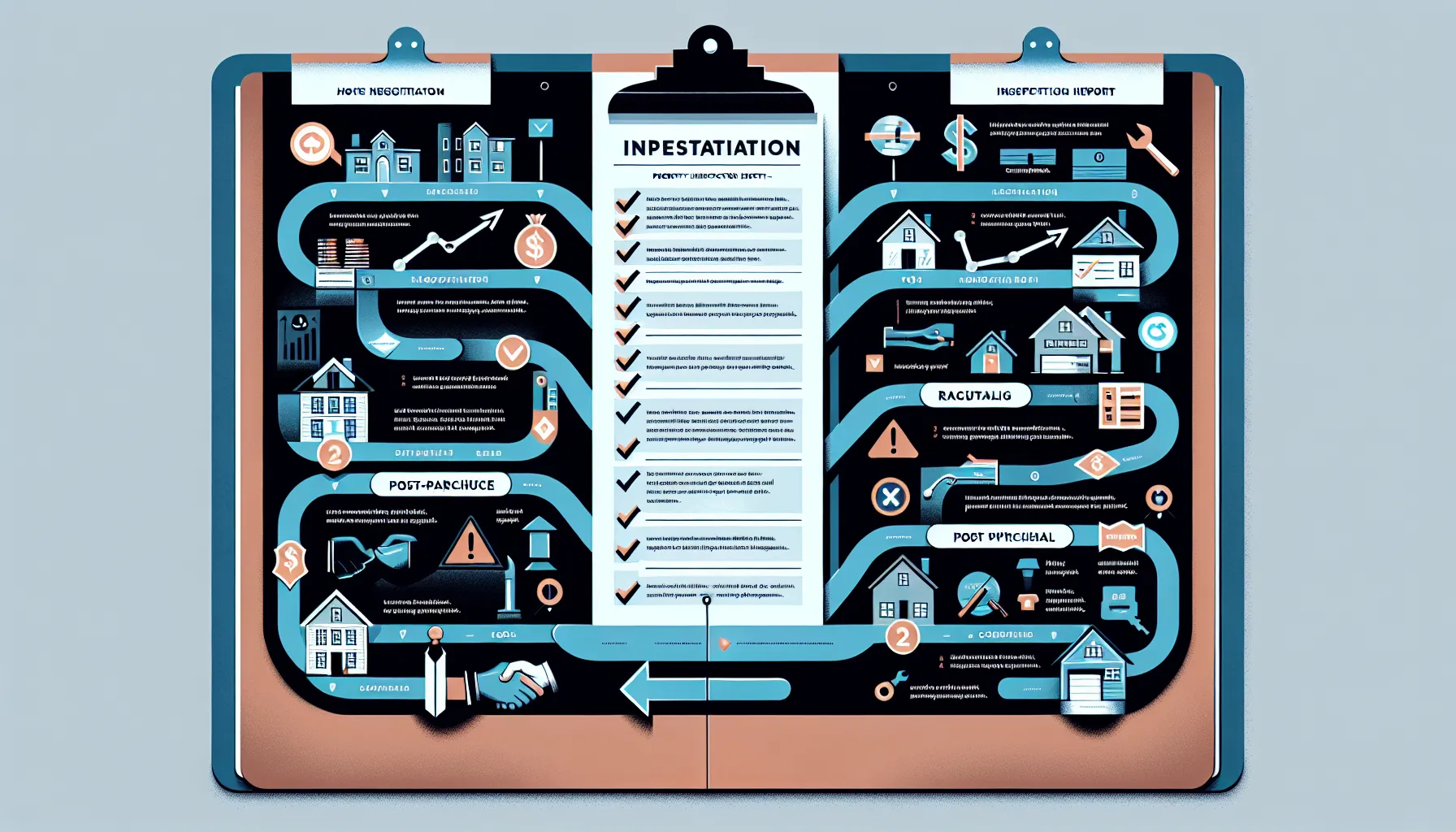

Negotiating Repairs or Price Adjustments

After receiving the inspection report, I study it carefully and highlight anything needing further action. Significant issues, like roof leaks, HVAC problems, or major electrical findings, often become points for negotiation. I might ask for repairs, a credit, or even a slight reduction in the purchase price. It’s important to approach these discussions cooperatively: my goal is a win-win, not to derail the deal. Have you thought about your priorities in a negotiation?

Post-Inspection Steps for Buyers

Once negotiations are settled, I use the inspection report as a maintenance roadmap. I keep it handy, especially during the first year of ownership. Items marked “monitor” remind me where to focus future upkeep. If a specialist is recommended, perhaps a plumber or engineer, I make those appointments promptly. The report isn’t just paperwork: it’s a guide to protecting property value for years to come.

Conclusion

Property inspections in Lafayette aren’t just another task on your closing checklist. They’re a gateway to making informed decisions with confidence. By understanding the process, common findings, and how to put your inspection report to work, you’ve already set yourself apart as a savvy buyer. I’ve seen how diligence at this stage pays off in peace of mind and financial clarity down the line. Ready to take the next step with your Lafayette property purchase? Arm yourself with the right knowledge and a trustworthy inspection partner, and you’ll be glad you did.

Frequently Asked Questions about Lafayette Property Inspections

What is included in a Lafayette property inspection?

A Lafayette property inspection typically covers the foundation, roof, plumbing, electrical systems, HVAC, appliances, and the overall structure. Inspectors also check for pests, moisture issues, and environmental hazards, tailoring their inspections based on property age and type.

How much does a property inspection cost in Lafayette?

The cost of a property inspection in Lafayette generally ranges from $350 to $600, depending on the property’s size and added services. Specialized inspections, such as mold or sewer line checks, may incur extra fees but provide valuable insight before purchasing.

Why are property inspections important when buying in Lafayette?

Property inspections in Lafayette help uncover hidden issues, such as foundation problems, outdated systems, or safety hazards. Knowing these details before closing helps buyers negotiate repairs or price adjustments and protects their investment.

What are common problems found during Lafayette property inspections?

Common issues include foundation cracks, settled slabs, outdated plumbing or electrical systems, moisture intrusion, and pest concerns. The region’s climate also means inspectors often watch for mold, insulation problems, and weather-related damage.

How do I choose a qualified property inspector in Lafayette?

Choose a property inspector with proper licensing, industry certifications, and local experience in Lafayette. Ask about their inspection approach, sample reports, references, and insurance coverage to ensure comprehensive and professional service.

Can an inspection report help me negotiate the home price?

Yes, the inspection report can be a valuable negotiation tool for repairs or price adjustments. Major issues identified in the report allow buyers to request fixes, credits, or adjustments, ensuring they get fair value for their investment.