Owning rental property in Danville is often seen as a smart move, whether you’re a local investor or someone who’s moved out of the area but wants to hold on to your California investment. But how do you handle the everyday details that come with property management? Maybe you wonder if you’re maximizing your returns or providing a positive experience for your tenants.

I’ve found that even the most seasoned investors have questions, especially when it comes to keeping up with trends, regulations, and the demands of multiple properties. If you’re searching for a clear, reliable approach to Danville investment rental support that makes your life easier, you’re in the right place. Let’s take an honest look at what’s working in our local market, what you should be asking, and how to set yourself up for long-term success.

Key Takeaways

- Danville investment rental support empowers property owners to maximize returns while minimizing daily management hassles.

- High tenant demand and community stability in Danville result in low vacancy rates and reliable rental income for investors.

- Choosing the right property management solution—Silver, Gold, or Platinum packages—ensures tailored support for both single-property owners and portfolio investors.

- Regular inspections, proactive maintenance, and clear communication are critical for long-term rental property success in Danville.

- Staying informed about local regulations and leveraging professional support helps keep your Danville investment compliant and profitable.

Understanding the Danville Rental Market

Over the years, I’ve watched Danville’s rental market shift right alongside Bay Area trends. Demand for rental homes remains steady, especially with families seeking good schools and quieter neighborhoods within reach of major job centers. Home values hold strong, but this also means renters have high expectations.

What does this mean for you as an investor or landlord? For one, competition among high-quality rentals can actually work in your favor when properties are managed well. I often see renters prioritizing condition, amenities, and responsive management above all else.

Vacancy rates in Danville tend to be lower compared to some neighboring cities, but they’re not immune to seasonal swings, especially around school calendars. Rents have steadily increased over the past few years, but growth has slowed somewhat given statewide pressures around affordability and new tenant protections. Staying current on these trends is something I focus on closely: acting early often makes a significant difference in reducing costly gaps between tenants.

If you’re new to the area or you’ve moved out of state, having boots on the ground truly changes the game. I routinely assist homeowners who would rather not worry about logistics, from maintenance calls to inspections, and this provides lasting peace of mind along with steady income.

Key Benefits of Investing in Danville Rental Properties

Why do investors keep coming back to Danville? There are several answers, but a few stand out every time I sit down with owners and aspiring landlords.

1. Strong, Consistent Returns

Rental yields in Danville won’t always be the highest on paper, but the combination of reliable income and long-term appreciation makes this market attractive. My clients appreciate the balance between stability and growth, they don’t want surprises, just real progress on their investment goals.

2. Desirable Tenant Pool

Danville’s schools, parks, and safe reputation naturally attract families and professionals who tend to be reliable, long-term tenants. I’ve noticed fewer turnovers here than in more transient neighborhoods, saving investors both time and money.

3. High Property Standards

Homes in Danville often command premium rents because they’re well-maintained. Residents expect prompt service and clear communication, delivering on these expectations can justify top dollar and keep tenants happy for years.

4. Community Stability

Unlike some markets that feel like a rollercoaster, Danville’s community roots run deep. The area’s limited rental inventory and steady inflow of families create a solid environment for real estate investing.

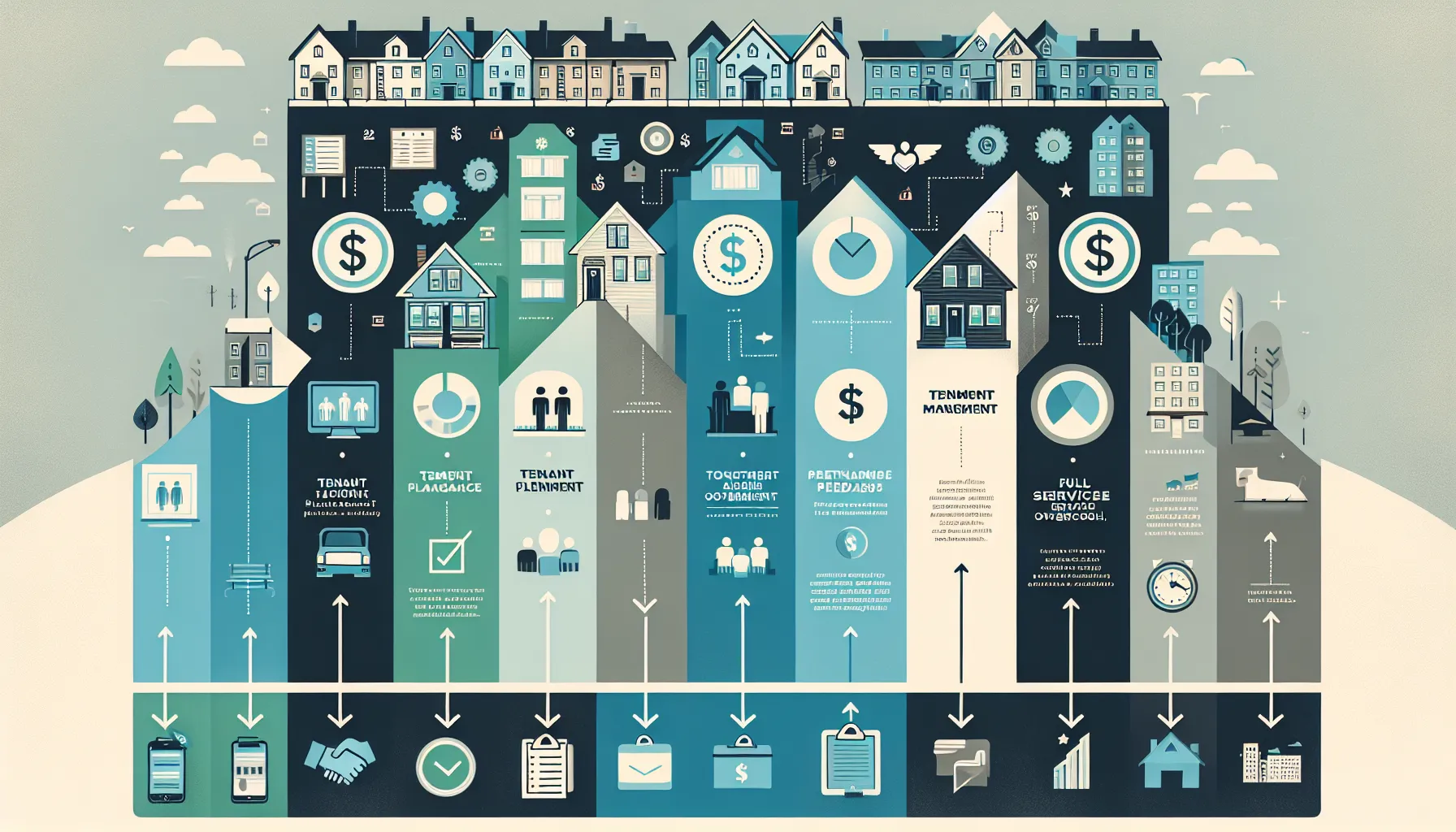

Types of Investment Rental Support Available

Managing a single rental is vastly different than running a portfolio, but every landlord needs reliable support to succeed. I offer a range of services and packages to match your needs, whether you’re an out-of-area homeowner or a well-established investor with up to ten properties.

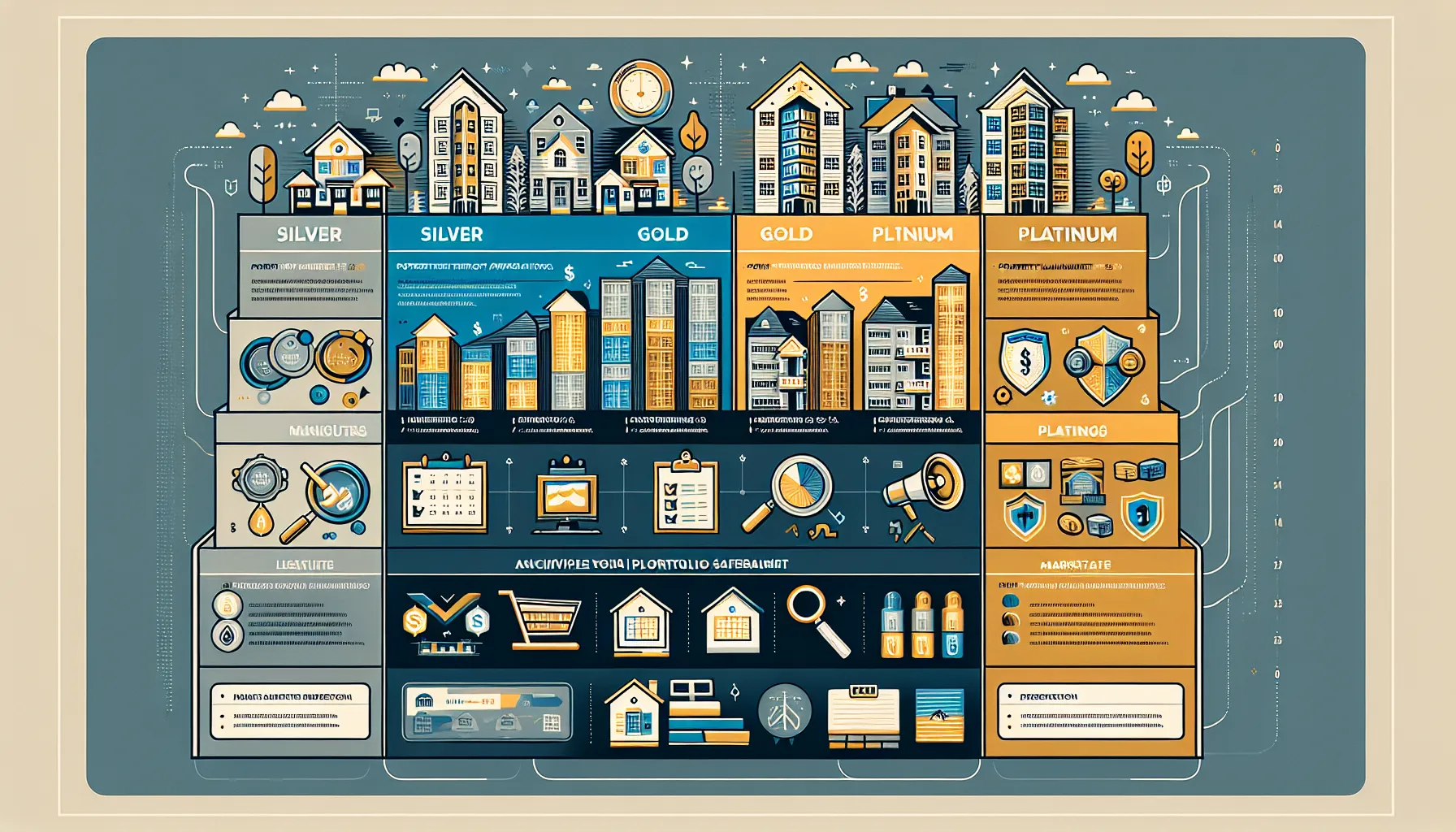

Property Management Packages

- Silver Package: Suited for rentals with a gross monthly total of $10,001 to $17,000. Includes a $199 leasing fee, 7.5% monthly management fee, and a one-time setup fee of $100. You’ll also benefit from scheduled inspections, marketing support, and more.

- Gold Package: Ideal for gross rents from $17,001 to $30,000 monthly. The leasing fee remains $199, but the management fee drops to 7%. This package covers all Silver benefits and adds extra attention for higher-value investments.

- Platinum Package: For properties earning $30,001 or more in gross rents per month. The service structure mirrors Gold, but I bring additional expertise and resources to safeguard complex, high-value portfolios.

Additional Services and Support

- Appraisal Access Assistance: For a flat fee, I coordinate directly with appraisers to schedule property visits, simplifying what can become a logistical headache.

- Semi-Annual or Annual Inspections: Regular maintenance checkups help avoid costly surprises by catching issues early.

- Home Improvement Oversight: Managing upgrades and repairs efficiently, typically at a set percentage of project cost, ensures you maintain or even increase market value.

- Insurance Claim Management: If unexpected damage, I handle the paperwork and communication, so you don’t have to play phone tag with insurers.

These services are designed to create a stress-free, hands-off experience for both new landlords and experienced investors. I want you to focus on your bigger goals, not the day-to-day tasks.

Choosing the Right Property Management Solutions

Deciding which property management solution fits best isn’t always straightforward. I see a wide range of investor profiles in Danville, from families keeping one rental after a move, to professionals managing a small portfolio of homes. Each scenario deserves thoughtful attention.

Ask yourself: What’s my expected monthly rental income? How hands-off do I want to be? If you’re managing five or more homes, efficiency and unified reporting often become essential, plus to prompt service for both you and your tenants.

You might need help just finding high-quality tenants and responding to their maintenance requests, or you may prefer complete oversight and proactive reporting. In my experience, new landlords sometimes underestimate the value of regular inspections or legal compliance checks, both protect your investment over the long haul.

Most importantly, whichever package you opt for, make sure you’re working with someone who communicates clearly and takes pride in fast response times. A little extra service on the front end almost always pays dividends through satisfied tenants and steady income.

Property management shouldn’t feel complicated: it should feel like a reliable partnership that lets you sleep well at night.

Legal and Financial Considerations for Danville Investors

Managing rentals here means keeping pace with local and state housing laws, California isn’t shy about updating regulations. I prioritize staying informed around tenant screening, fair housing, eviction rules, and habitability standards, because I know how fast things can change.

Have you considered the impact of new rent control measures or security deposit guidelines on your business model? Many clients are surprised to find that even seemingly minor rule changes can affect profitability or require adjustments to lease agreements.

Financially, working with a managing partner helps you keep better records, important at tax time and if you’re ever audited. Accurate monthly statements, clear tracking of maintenance expenses, and detailed end-of-year summaries give you confidence come tax season and if you decide to expand your portfolio.

Don’t overlook insurance, either. Your regular policy may not cover everything, so I always review options for liability and property damage to protect your bottom line. I also handle insurance claim paperwork and follow-through, removing yet another source of stress.

If you’re unsure what’s required, or want reassurance that your properties are fully protected and compliant, I’m always happy to answer questions or review your current setup.

Conclusion

Danville investment rental support is more than just oversight, it’s about maximizing your returns while avoiding everyday headaches. Whether you own a single home or a group of properties, the right local partner empowers you to grow your investment in California’s sought-after market, with clarity and confidence. If you’re curious about specific options or want to discuss what would work best for you, reach out. I’m here to help turn your real estate goals into reality, making property ownership not just profitable, but genuinely rewarding.

Frequently Asked Questions about Danville Investment Rental Support

What is Danville investment rental support and how can it benefit landlords?

Danville investment rental support refers to services that help property owners manage their rental properties efficiently. This includes handling tenant inquiries, maintenance, inspections, and ensuring compliance with local regulations—all aimed at maximizing rental returns and minimizing the stress of day-to-day management.

How does the local Danville rental market impact investment returns?

Danville’s rental market is characterized by steady demand, especially from families seeking good schools and safe neighborhoods. This stable environment leads to lower vacancy rates and reliable rental income, making it attractive for long-term real estate investors.

What types of property management packages are available in Danville?

Danville offers tiered property management packages, typically including Silver, Gold, and Platinum levels. These packages cover services like leasing, regular inspections, marketing, maintenance coordination, and comprehensive oversight for both single rentals and larger portfolios.

How do recent California rental laws affect Danville landlords?

New California rental laws, such as changes in rent control and tenant protections, can influence lease terms and profitability. Staying informed and working with local experts ensures your properties remain compliant, minimizing legal risks and unexpected costs.

Can I manage my Danville rental property remotely with professional support?

Yes, many investors successfully manage Danville rentals from outside the area by partnering with local rental support services. These partners handle maintenance, tenant issues, and inspections, giving remote owners peace of mind and steady rental income.

What should I look for in a Danville investment rental support provider?

Choose a provider with strong local market knowledge, clear communication, and a proven track record in property management. Look for services offering regular inspections, prompt maintenance responses, financial transparency, and expertise in California rental regulations.